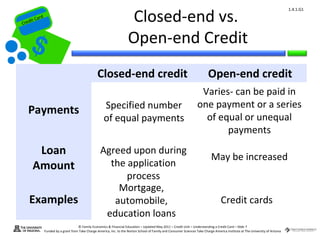

closed end loan vs open end

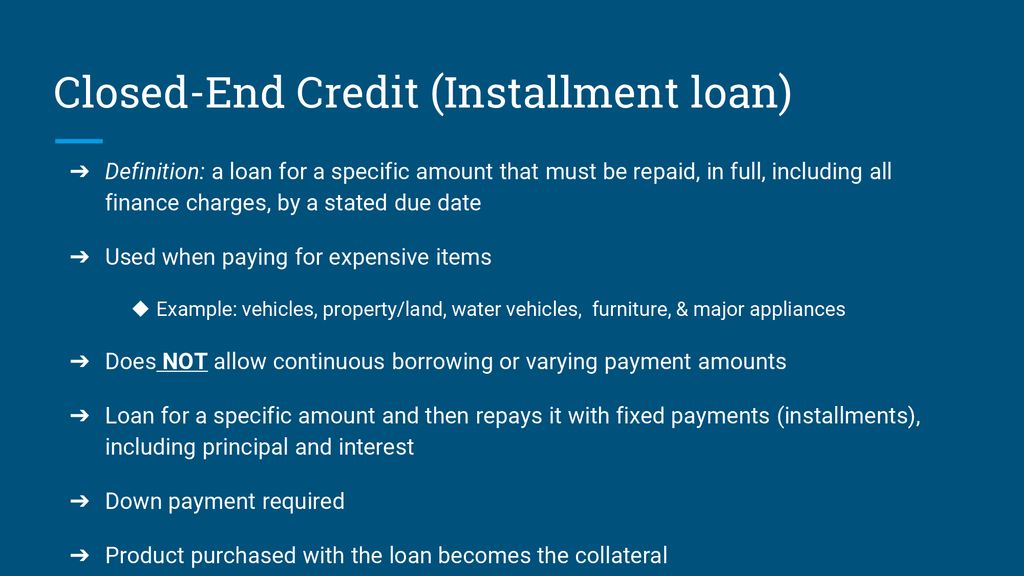

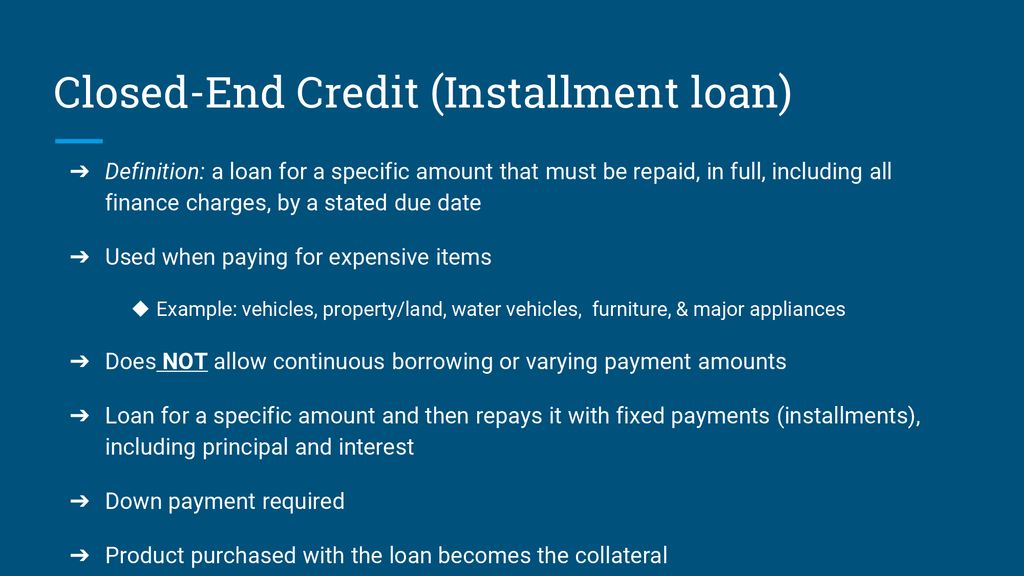

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a. Closed-end credit is used for a specific purpose for a specific.

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

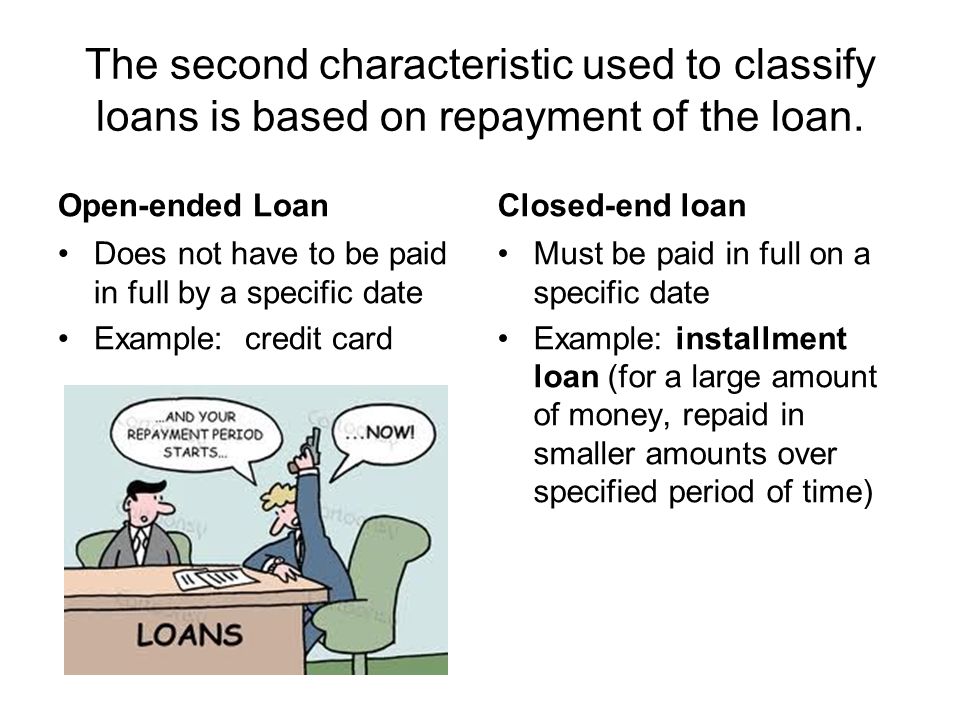

Consumer lending products aka consumer loans can be open-end credit or closed-end credit.

. It remains open and it. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. Comparisons Trusted Low Interest Rates.

The borrower can reuse. Closed-end installments and open-end revolving Closed-end credit. Consumer credit falls into two broad categories.

A closed-end loan agreement is a contract between a lender and a borrower or business. A loan can be closed-end or open-end. Open-end leases and closed-end leases are two different ways of leasing a car.

A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. A line of. In a closed-end lease the leasing company takes on the risk of any additional depreciation.

In a Nutshell. Examples of open-ended loans include lines of credit and credit cards. Get Instantly Matched with the Best Personal Loan Option for You.

A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the. Skip the Bank Save.

Citizens Pay Awarded Best Innovation from the 2022 Banking Tech Awards USA. A borrower may repay the. Closed-end credit is a type of loan where the borrower receives a large lump sum upfront and agrees to pay back the full balance over a specific period of time like a mortgage.

When you lease a car youll usually be offered a closed-end lease. An open-ended loan is a loan that does not have a definite end date. When it comes to paying off your mortgage you need to decide between two payment structures.

Open end credit is also known as a revolving line of credit and is arranged as a pre-approved amount of credit with no set end date or expiration date. While both options use the cars residual value to calculate your monthly. Open-end credit is not restricted to a specific use.

One important feature of closed-end loans are flexible terms that allow you to adjust your loan term to fit your budget. Ad Committed to providing cutting-edge tech combined with best-in-class products offerings. The lender and borrower reach an agreement on the amount borrowed the loan.

What is Open End vs Closed-End Credit. Ad With A TD Fit Loan You Dont Need To Use Your Home Or Other Assets To Borrow. The one you choose determines.

A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment. Ad 7 Best Personal Loan Company Reviews of 2022. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

Borrow The Amount You Need All At Once With Funds Available As Soon As The Next Day. Installment loans including a 144-month auto loan are examples of closed. For instance you can spread out your mortgage.

This type of mortgage.

Lending Banking Finance Ppt Download

/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Lesson 16 2 Types Sources Of Credit Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Difference Between Open End Credit And Closed End Credit

Factors To Consider When Choosing Personal Line Of Credit Toyota Fcu

Solved 32 The Truth In Lending Act Includes O Closed End Chegg Com

What Are Closed End Funds Fidelity

Understanding A Credit Card Ppt Download

Closed End Credit Awesomefintech Blog

Credit Basics Open Vs Closed Ended Credit Open Ended Credit Is Ongoing You Borrow You Repay You Borrow Again As Long As You Do Not Exceed Your Credit Ppt Download

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Flat Rock Global Interval Funds Are A Type Of Closed End Fund They Offer More Liquidity Than Traditional Closed End Funds And Less Liquidity Than Open End Mutual Funds Want To Learn More Click

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)